della Dott.ssa Alice Pizziconi

Table of contents

- The pharmaceutical industry………………………………………………………………….4

- How it works………………………………………………………………………………………..4

- Pharmaceuticals is the largest R&D investment in the word………… …………….5

- Great progress with precision medicine resulting from synergies between science and technology………………………………………………………………………………………..5

- Pharmaceutical industry in Italy: increasingly committed to Research…………6

- High competitiveness: a unique business mix in Europe and the strength of pharmaceutical specialisations in Italy………………………………………………..….7

- The impact of Covid-19 on pharmaceuticals and the economy…………………..…8

- Vaccines and prevention……………………………………………………10

- Vaccines are crucial for the health and sustainability of the National Health System………………………………………………………..11

- Types of vaccines…………………………………………………….12

- Vaccine regulation: a little bit of historical background……………..12

- The vaccine law………………………………………………………13

- The covid-19 vaccines………………………………………………………14

- The First Steps Toward an mRNA Vaccine…………….……………16

- What they are and how they work……………………….…………..16

- Production and supply of Covid-19 vaccines…………….………….17

- Covid-19 vaccines: development, evaluation, approval and monitoring……………………………………………………………23

- Patents and Regulation: a general overview…………………………25

- Patents and Regulation: the Covid-19 case…………………………..29

- Pharmaceutical inventions and the complex relationship between industrial property rights and health protection………………………37

- Competition in the regulatory and economic landscape of Covid-19 vaccines………………………………………………………………42

- Economic analysis of Covid-19 vaccines …………………………………49

- Covid-19 related profits………………………………………………51

- Covid-19 vaccine companies and the subsidies from governments…………………………………………………………52

- Covid-19 vaccine companies and the profit spending………….……55

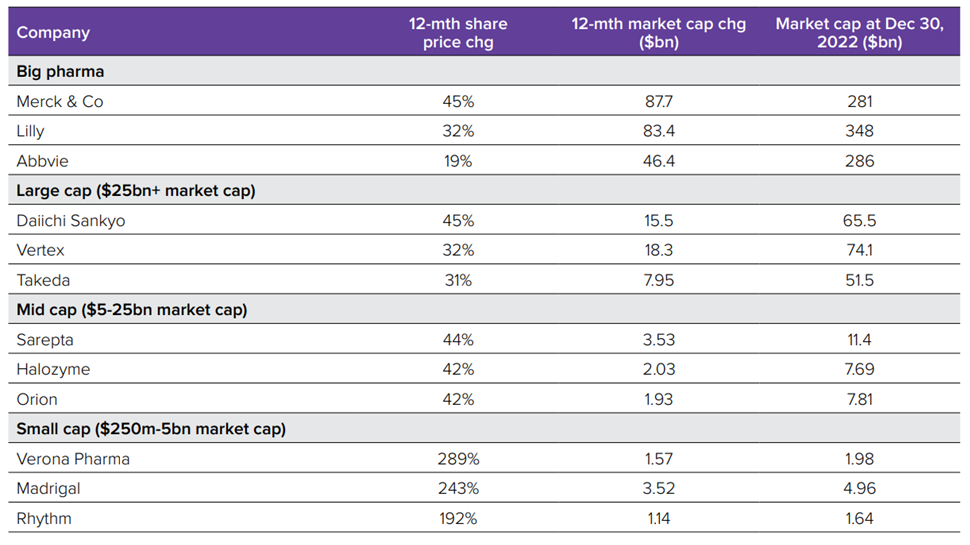

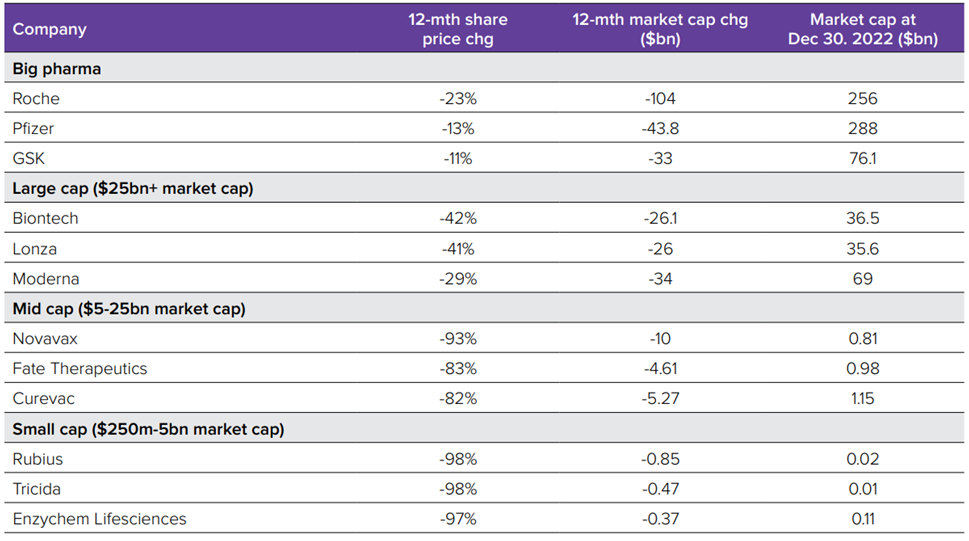

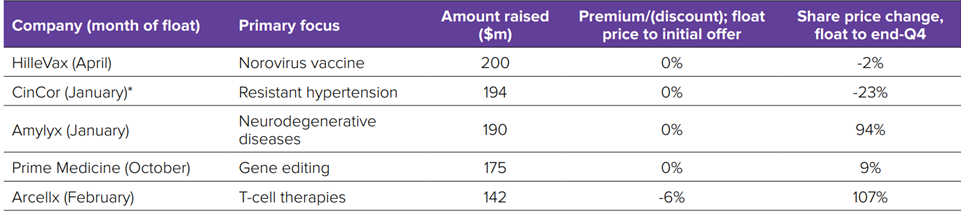

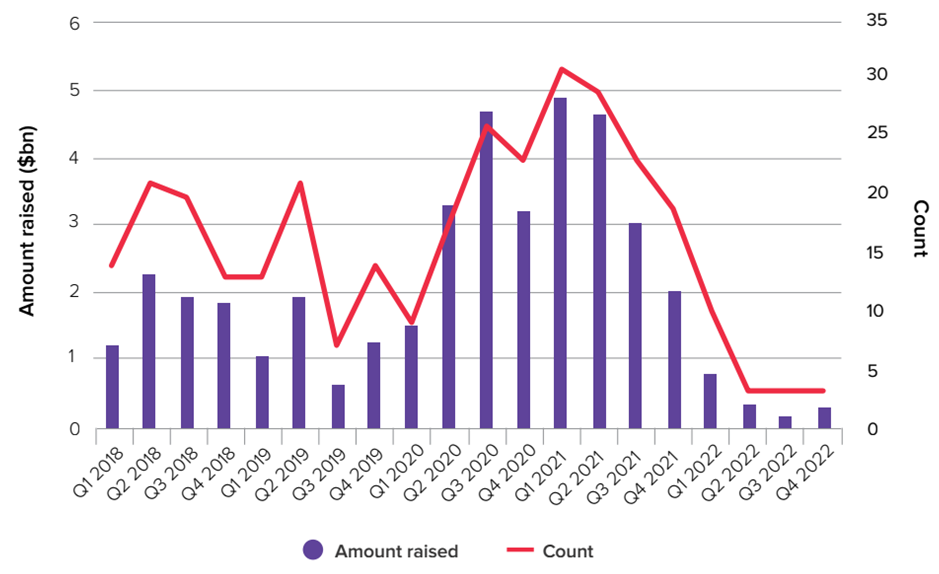

- Biopharma’s stock market winners in 2022, the flotations fail and venture investments………………………………………….…..…..57

- The beginning of a new era: next-generation therapeutics, with the contribution of Dr Rino Rappuoli…………………………………………61

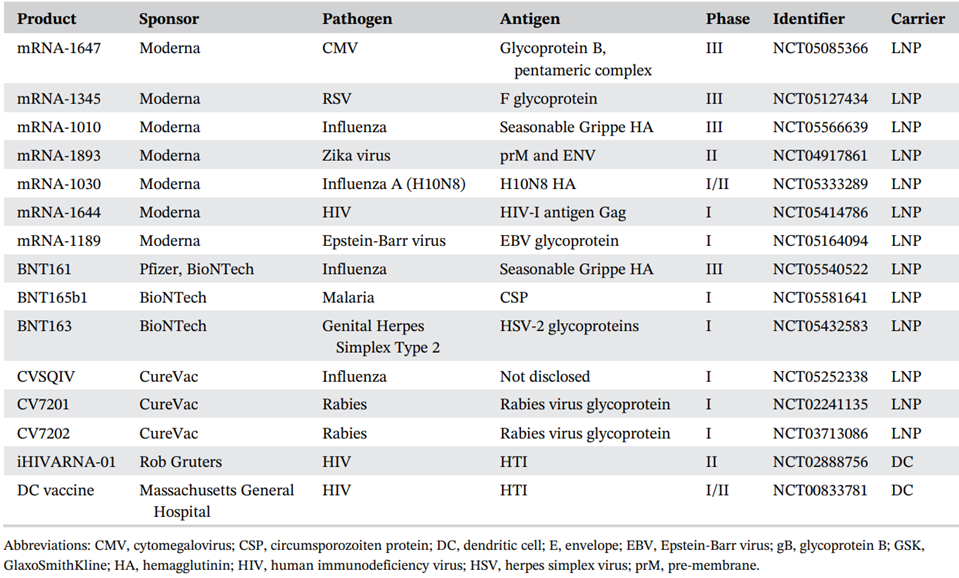

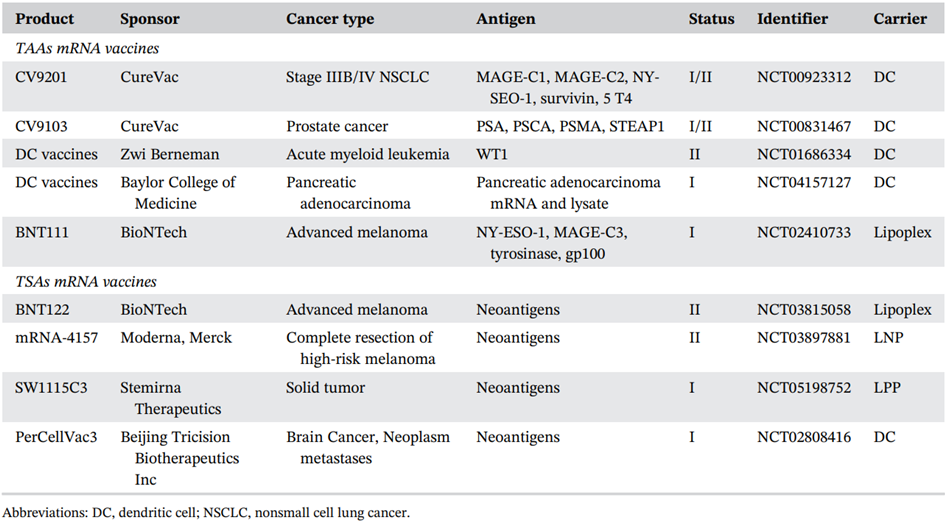

- Relevant mRNA vaccine developments: infectious diseases and cancer………………………………………………………………..62

- The regulatory and legislative situation and perspectives, with the contribution of Dr Rino Rappuoli……………………………………65

- The economic highlights of this new technology, with the contribution of Dr Rino Rappuoli………………………………………………….68

- Future challenges and opportunities for the mRNA vaccines, with the contribution of Dr Rino Rappuoli……………………………………70

Conclusions…………………………………………………………………75

References………………………………………………………………….79

- The pharmaceutical industry

One of the largest and most active sectors in the world, the pharmaceutical sector has 1.2 trillion dollars in revenue and an added value of over 500 billion. More than 60% of the world’s added value is produced in Asia and Europe, yet only the USA accounts for 50% of sales. Ten significant multinational corporations with US and European capital account for about one third of worldwide sales.

With a production value of more than 32 billion euros and an added value equivalent to 0.6% of the national GDP, Italy holds a dominant position at the European level.

When compared to other industrial sectors, the Italian pharmaceutical business has higher added value per employee (+118% over the manufacturing average), larger investments per employee (+313%), and a pronounced propensity to export (+246%), according to competitiveness indexes.[1]

- How it works

The development, manufacture, and marketing of pharmaceuticals are under the purview of the pharmaceutical industry. There are distinct and highly specialized stakeholders present in this complicated and articulated supply chain.

Manufacturers and marketing authorization holders are further up the supply chain (MAs). They are the companies that use a variety of production inputs from the most diverse industries to create the medicine, such as mechanics, chemistry, building materials, plastic, and printed matter, but they outsource distribution. Third parties are in charge of the distribution phase. There is a separation between wholesalers and warehouses. The former are merely in charge of the actual distribution to wholesalers on behalf of the pharmaceutical businesses; they do not own the drug they handle. Depositaries frequently hire specialized transporters to handle the transit procedure instead of handling it themselves. Conversely, wholesalers are required to supply pharmaceuticals in a limited amount of time and are the legal owners of the drugs they sell. Because of this, wholesalers set up shop close to facilities that disperse medications to patients (such pharmacies or hospitals) and make investments in automation, innovation, and technology.

The locations where the patient can pick up or purchase the medication are known as dispensing sites. These locations include ASLs and hospitals as well as pharmacies, parapharmacies, and corners in large retail stores (established as a result of the Bersani Decree, which liberalized the marketing of over-the-counter drugs).

- Pharmaceuticals is the largest R&D investment in the world

Pharmaceutical research and development is a wise investment in growth, safety, and health.

Pharmaceutical companies will invest EUR 1,300 billion between 2021 and 2026, 80% of which will go into an open innovation network made up of various players, including companies, public bodies, start-ups, science parks, and clinical centers. According to the European Commission, the pharmaceutical industry leads the world in terms of R&D investment, both in terms of absolute value and as a percentage of total revenue. A fantastic chance for Italy that might result in an increase in both investment and employment.

84 new medicines were approved globally in 2021. The prospect of a cure for patients and increasingly personalized therapy is boosted by this number, which is the greatest in the last 10 years (55 each year on average) and the more than 18,000 goods under development (some of which will become therapies).[2]

Through funding research, one can increase the health and life expectancy of the populace as well as draw in fresh talent and resources for the economic and social advancement of the nation. To strengthen the innovation ecosystem, basic research, clinical trials, patent registration and protection, technology, and digital data transfer require a desirable environment.

- Great progress with precision medicine resulting from synergies between science and technology

The expansion of the product pipeline is a continual innovation process that can take many different forms but is essential to better meeting patient health demands and raising the competitiveness of the nation.

Gene, somatic cell, and tissue engineering therapies are some of the increasingly specialized goods made possible by scientific and technological advancements as well as the evolution of R&D. These advancements have caused a radical paradigm to shift from therapies based on the “one size fits all” theory to precision medicine and eventually to advanced therapies and “next generation biotherapeutics,” which include these therapies.

With exponential acceleration brought on by network innovation and collaborations with businesses in the digital sector, this is a particularly exciting phase of innovation. Firstly, from science, with a better understanding of people’s genetic make-up, then from technology, thanks to the ability to monitor and analyse massive amounts of data using Big Data Analytics techniques.

The life sciences are moving toward “precision health,” a concept that has significant scientific and societal significance since it allows for better illness detection, earlier diagnosis, more focused and efficient treatment, and less side effects.

- Pharmaceutical industry in Italy: increasingly committed to Research

Pharmaceutical businesses spent EUR 1.7 billion in research and development in 2021, accounting for 6% of all investments made in Italy (+3.7% from 2020).

R&D investment growth from 2016 to 2021 was 14%, a trend that produced some very significant outcomes, particularly in some areas of specialization and increasingly as a result of collaborations with public structures. [3] For instance, biotech medications, vaccines, plasma-derived goods, cutting-edge medicines, and orphan medications.

Companies invest more than EUR 700 million annually in clinical research in Italy (42% of the total on biotech drugs and advanced therapies, 32% of the total on rare diseases and 48% on phase 1 and 2 studies), a crucial step in gaining access to therapies. They frequently do this through SSN structures, while also providing opportunities for professional advancement to doctors and researchers, making cutting-edge therapies accessible to patients while covering all associated costs, such as hospitalization and diagnostic tests.

According to ALTEMS, clinical trial investments return a total of three euros to the NHS for every euro invested. Also, the pharmaceutical industry leads the way in Open Innovation and the percentage of businesses that collaborate with universities and public research institutions. Proof of the significance of pharmaceutical company presence for the expansion of the nation’s whole R&D ecosystem.

- High competitiveness: a unique business mix in Europe and the strength of pharmaceutical specialisations in Italy

With a balanced contribution from businesses with Italian capital, which determines 42% of the industrial function, and those with international capital, which depends on 58%, the pharmaceutical sector in Italy is distinguished by a composition that is unique in Europe.

Pharmaceutical firms take the lead among all the internationally financed businesses in Italy in terms of employment, added value, investments, exports, and also generate significant value through induced purchases.

Italy tops the list of the major European nations for the presence of businesses with US, German, French, Swiss, and Japanese capital. In addition, for businesses with UK funding, it serves as a global base for the manufacture of vaccines.

Italian-owned businesses stand out for their expanding investment in production and research as well as their about 75% of total sales made abroad, which is notably greater than the average manufacturing industry’s growth rate of 40%. Overseas sales have more than tripled over the past 15 years (from 3.1 billion in 2007 to 9.2 billion in 2021), not because of delocalization but rather due to the emergence of new markets, which has allowed Italy to increase its R&D and manufacturing presence. Moreover, Italy leads all of Europe in terms of the number of pharmaceutical SMEs.

The pharmaceutical industry’s expansion is also related to the specializations within it, such as biotech drugs, which are seeing increased investment and a sizable pipeline of products under development, increasingly in advanced therapies, which are also the result of partnerships between businesses and other participants in the national innovation ecosystem.

With a strong scientific background and a strong vocation for exports, Italy is a global R&D and production powerhouse for vaccines. This has allowed it to build up a 4-billion-dollar positive external balance in just ten years.

The Contract Development and Manufacturing Organisation (CDMO), commonly referred to as contract manufacturing, is one area in which Italy leads in Europe. Nowadays, the sector accounts for 2.7 billion in production, or 23% of all production in Europe, in partially due to investments.

Plasma-derived products are one of the specializations, made possible by national businesses with a strong international focus and significant businesses with foreign capital that, in total, employ about 2,000 people and make production and research investments that are significantly higher than the manufacturing average.

- The impact of Covid-19 on pharmaceuticals and the economy

Coronavirus disease (COVID-19) is an infectious disease caused by the SARS-CoV-2 virus.[4]

The pharmaceutical industry is one of the rare exceptions in the crisis environment brought on by the Covid-19 pandemic, continuing to exhibit a robust dynamic and promising development prospect.

But, in this situation, the sector’s organizational structure is not impervious to the significant changes that the numerous lockdowns have brought about on a worldwide scale. In fact, the closures that occurred one after another at various times and in various ways in the major geographic areas have brought attention to the interdependencies and fragilities of a sector distinguished by long and articulated value chains.

In managing the pandemic, the pharmaceutical industry faced a number of difficulties, including difficulty providing the demand for protective gear and diagnostic testing facilities. Pharmaceutical businesses heavily rely on materials manufactured in China, where the Coronavirus infectious disease first emerged in December 2019, as China holds the global monopoly on the manufacture of active components (up to 60% of China’s production)[5].

Due to the closure of facilities, particularly in China, where the majority of pharmacological products are produced, the Covid-19 pandemic has had a direct impact on the scarcity of medical supplies, supply chain uncertainty, logistics, and transportation.[6] The real economy was threatened by the difficulties encountered in commercial transactions and the flow of resources[7]. As a result, businesses either charged expensive prices for these supplies or refused to sell them because they had insufficient stock.

Rules designed to stop the COVID-19 outbreak from spreading restricted the capacity to procure raw materials, make, and deliver medications. In developing and poor nations without enough domestic production capabilities, this presented a significant difficulty. These nations are under tremendous pressure to negotiate affordable treatment choices for individuals in need because of their reliance on imports.[8]

Because of the impact this pandemic will have on low- and middle-income countries’ (LMICs’) fragile healthcare systems, they will face particular difficulties. Healthcare systems in LMICs had a difficult time offering high-quality, reasonably priced, and widely accessible care prior to the COVID-19 pandemic. These healthcare systems lacked appropriate funding, qualified healthcare professionals, and medicine was not readily available. There is a gap in the creation of medications for other chronic diseases as a result of giving priority to COVID-19-targeted drugs and equipment.[9]

The impact of the outbreak on the healthcare industry was shown in the escalating death tolls brought on by inadequate medicine supplies, a lack of vaccination therapy alternatives, inadequate hospital treatment capacity, and a lack of quarantine facilities to handle the mounting COVID-19 infections.[10]

The health problem quickly turned into a global economic crisis. These disastrous effects can be explained by two main aspects. First, due to the virus’s exponential pace of transmission and the increased uncertainty about how terrible things could go, consumers, investors, and global trading partners fled for safety in their spending and investments. Second, as the virus spread, it promoted social withdrawal, which closed down financial markets, companies and businesses, and all other kind of activity or event.

Global stock markets lost nearly US$6 trillion in value in one week from February 23 to 28, 2020, according to S&P Dow Jones Indices, as a result of fear and uncertainty as well as a logical estimate that corporations’ profits were expected to be lower owing to the impact of COVID-19. In the same week, the US S&P 500 index lost more than $5 trillion in value, falling from 3,373 to 2,409, the Nikkei index dropped by 29%, from 23,479 to 16,552, while the FTSE 250 index dropped by 41.3%, from 21,866 to 12,830. In addition, the top 10 S&P 500 businesses collectively lost more than $1.4 trillion.[11]

Given that China was the world’s largest manufacturer and exporter and that the Chinese government had ordered the shutdown of important facilities there, the flow of commodities via worldwide supply chains was drastically restricted.

There was widespread agreement among economists that the pandemic would cause a global recession, and that such stay-at-home policies had sown the seeds of recession in industrialized nations.[12]

In March, the International Monetary Fund predicted a worldwide recession at least as severe as the one that occurred during the global financial crisis of 2007–2008, followed by a recovery in 2021.[13]

As of March 2022, data from the World Health Organization indicated that the COVID pandemic had a varied impact on each region. For instance, the European region experienced the greatest COVID spread, accounting for 41% of all confirmed cases and 31% of all COVID-related deaths. The second-largest geographic dispersion was in the Americas, which included 32% of all confirmed cases and 45% of all COVID-related deaths. The Eastern Mediterranean and African regions had the fewest cases that were confirmed, and the Western Pacific and African regions had the fewest fatalities overall.

The pandemic’s enormous scale and, more importantly, the impact it had during its early stages of propagation led many MPs to favor a policy of extended social isolation while denouncing its negative effects on the economy. The difficult decision that governments had to make over whether to rescue the economy before saving the people or to save the people before preserving the economy was reflected in the recession that followed, which many countries faced.

Vaccines are biological compounds that work to protect the body from infectious diseases by triggering an immune response. Vaccinations guarantee the control of target diseases and the reduction of their incidence, up to, in some situations, up to, in some cases, worldwide eradication, if applied consistently and in accordance with approved plans.[14]

Due to their qualities, vaccinations are one of the best tools for sustainable spending because, by avoiding the spread of diseases, they not only contribute significantly to the population’s health but also result in large financial savings.

- Vaccines are crucial for the health and sustainability of the National Health System

The Covid pandemic brought to light the significance of vaccines, which have allowed for the eradication of some diseases and the control of others, lowering mortality rates and saving millions of lives. Due to their ability to prevent the overuse of antibiotics and the emergence of resistant bacteria, vaccines are also a valuable instrument in the global fight against antimicrobial resistance. Due to the fact that they lower the risk of illness and complications, they are especially essential for the protection of those who are chronically unwell.

For instance, according to data from Vaccines Europe, flu vaccination lowers the incidence of stroke by 24%, heart attack events by 50%, and diabetic patient fatalities by 28%. A contribution that prevents 25,000 deaths in Europe each year while also saving 250 million euros by lowering hospital stays and doctor visits. Another example involving Italy demonstrates that, in 18 years of hepatitis B vaccination, our National Health Service saved a total of €580 million.

So, vaccinations are an investment in the SSN’s sustainability in addition to being good for your health. The cost of the disease prevented as a result of vaccination is 1:16 the cost of immunization. The cost-benefit ratio increases to 1:44 when the resources produced by healthier people are also taken into consideration.

The introduction of effective models of sustainable procurement, with procedures that prioritize greater quality, innovation, and therapeutic value, and with clear indications of needs, is important to assure access and availability of dosages in a setting of growing worldwide competition for supplies.

- Types of vaccines

Vaccines can differ depending on whether the antigens at their core are attenuated, allowing the recipient organism to respond to them without being overwhelmed, or inactivated, putting viruses and bacteria through a process that prevents their ability to replicate by blocking their ability to make proteins through heat or chemical treatment.

Another type of vaccines, in terms of organics, are those that use purified immunogens. These vaccines, which are frequently referred to as “unconjugated saccharide” (or “subunit” (split) vaccines) because they only use fragments of the relevant antigens, are concentrated on bacterial or viral substances that, after being purified and detoxified through modification of the pathogens’ polysaccharide capsule or their protein structure, can trigger a protective immune. Contrarily, conjugated vaccines are made up of many microorganisms that, when combined, produce immunogenic properties that were not there before. The last option is anatoxin vaccines, which are made from molecules from the infectious agent and are adequate to activate the body’s immune defences despite not being able to cause disease.[15]

- Vaccine regulation: a little bit of historical background

Early in the 19th century, as smallpox vaccination swept throughout Europe, the practice of requiring vaccinations became widespread. In reality, doctors had observed that by safeguarding the individual, it was possible to stop the pandemic from spreading to the entire community, but they had also noted that this required extremely high levels of commitment. Together with enthusiasm, the introduction of vaccination sparked strong opposition.

According to a school of thought that originated in Germany, the state must actively take care of keeping its subjects in the best possible state of health in order to obtain healthy and numerous soldiers and taxpayers, the decision to intervene in a mandatory and organized manner to protect public health was part of that school of thought. Smallpox vaccination was the first coercive measure to be spread throughout Europe, and it didn’t take long for it to encounter violent opposition in England, the birthplace of liberal doctrines opposed to anything that might come from the power of government and interfere with citizens’ freedom of choice.

Due to its great scientific contributions, its forward-thinking vaccination laws, the knowledge of its researchers and public health professionals, and even some industrial vaccine production, Italy has long been a leader in contemporary healthcare.

Four phases have been recognized regarding the development of vaccination policies in Italy over the first 40 years of the National Health Service. The first period (1978–1988) was marked by the eradication of smallpox, hopes for further eradication, and the introduction of the hepatitis B and acellular pertussis vaccines. A comparatively small number of vaccines were available during the initial phase of the universalist health reform of 1978, with safety goals taking a backseat to protective efficacy. The second period (1999–2008) was characterized by the introduction of the first national vaccination plans and the hypothesis of a gradual shift from mandatory to conscious adherence, marked by the significant experimentation of the Veneto Region. The third phase (2009–2014) was marked by the expansion of health information on the internet and social media, anti-scientific legal judgements, and an increase in vaccine hesitancy that resulted in misconceptions, generalized coverage declines, and the resurgence of epidemic outbreaks; The institutions responded during the most recent period (2015–18), which resulted in the PNPV 2017–19 being approved, the extension of vaccination requirements, and punishments against antivaccination doctors. This sparked a frenzied political and media debate about the moral and ethical implications of punishments and restrictions on the entrance of unvaccinated children to schools, as well as a sharp increase in coverage.[16]

- The vaccine law

The Vaccination Decree increased from four to 10 the number of mandatory vaccines for children and adolescents in our nation. The goal is to reverse the gradual reduction in vaccination rates—both required and recommended—that has been occurring since 2013 and has caused our nation’s average vaccine coverage to fall below 95%. The World Health Organization has suggested this level to ensure “herd immunity,” or the indirect protection of even individuals who cannot receive a vaccination due to health concerns. As stated in the agreement signed by the Permanent Conference for Relations between the State, the Regions and the Autonomous Provinces of Trento and Bolzano on January 19, 2017, it will also enable the achievement of the National Vaccine Prevention Plan’s top priorities for 2017 to 2019 as well as compliance with obligations made at the European and global levels.

Conversion Law No. 119 of July 2017, which revised Decree Law No. 73 of June 7, 2017, Requiring measures on vaccine prevention, effectively mandates vaccinations for children between the ages of zero and sixteen as well as unaccompanied foreign kids.[17][18]

- The covid-19 vaccines

Since the genetic code of the SARS-CoV-2 virus was revealed on January 11, 2020, scientists, business, and other organizations have worked together to create COVID-19 vaccinations as quickly as feasible.

Some vaccines are created utilizing the same technology (or “platform”) as those that are now in use, while others are created using fresh ideas or ideas that were recently employed in the creation of the SARS and Ebola vaccines. All of these vaccinations aim to trigger an immune response that will neutralize the virus and stop cell infection.

- Inactivated viral vaccines: the SARS-CoV-2 virus is cultured in cell cultures and chemically inactivated

- Living attenuated vaccines are created by creating a genetically weakened version of the virus that only partially replicates, does not spread disease, but instead triggers immune reactions like to those triggered by a genuine infection

- Recombinant protein vaccines: based on the spike protein, or receptor binding domain (RBD) or virus-like particles (VLPs)

- Viral vector vaccines: typically based on an existing virus carrying the genetic information for the spike protein (normally an adenovirus incapable of replicating)

- DNA vaccines: plasmid-based constructs that have been altered to carry genes that code for the spike protein, which the person receiving the vaccination subsequently produces.

- RNA vaccines: These vaccines are built on messenger RNA (mRNA), or self-replicating RNA, which contains the genetic code for the spike protein.[19]

One of the main problems associated with the development of these new vaccines is the controversial regulatory and intellectual property debate, which is already complex in the general pharmaceutical context, but even more so in situations such as the terrible Covid-19 pandemic that hit the world in December 2019. This global health crisis brought to light obvious issues related to the regulation of vaccines and their production, setting the stage for the start of an ethical and scientific debate that continues to this day.

Since the WTO’s inception (1994), each nation has the power to, under special conditions, limit the influence of pharmaceutical companies on its own soil by requiring them to permit the production of a protected drug that is deemed urgent by one or more third parties. It is a system known as “compulsory” licensing, which implies that the nation seeking to utilize it must pay the patent holder compensation. This exception was expanded by agreements reached in Doha in 2001 and formalized in 2005, which permit individual countries to issue mandatory licenses for the production of generic medications as well as the import and export of those drugs in support of other nations who are in need but unable to produce them. The European Union established a law governing the use of this instrument in the event of a health emergency in 2006. This was done specifically so that they would be prepared to respond to this kind of request.

The core principle of a patent is the transfer of technology from a private party (the inventor) to a public authority, which in each country where legal protection is sought is the patent office. In the pharmaceutical industry, this means that a company in the same field, with the necessary technical know-how, technology, and materials, should be able to reproduce it by reading the “recipe” of a vaccine, and consequently the composition and production methods of the active ingredient, as described in the application filed with a patent office. If it doesn’t, patents for vaccines against Covid-19 might not be issued on the legal presumption that not enough knowledge has been transferred and that too much production-related information (know-how) is still kept a secret.

It is crucial to emphasize that present rules give pharmaceutical corporations additional exclusive right over their products, which is treated like a trade secret, in addition to the patent. As a matter of fact, businesses are given the only right to the clinical trials and test results required for the development of a new drug, in accordance with safety regulations examined by organizations like the European Medicines Agency (EMA). Although extremely comparable to intellectual property rights, this exclusivity forbids the development of a generic before the elapse of a term that, under EU legislation, lasts between 8 and 10 years starting from the moment of marketing. It appears quite clear that without access to testing and clinical studies that would enable quick approval for manufacture, even if one or more governments were to restrict or temporarily stop vaccine patents, these steps would be insufficient for the creation of generics.

- The First Steps Toward an mRNA Vaccine

In place of conventional vaccine techniques, nucleic acid therapies have shown promising. In vitro transcribed (IVT) mRNA was successfully used in animals for the first time in a research that was published in 1990, when scientists learned that they could inject mice with mRNA and DNA to induce the production of a protein. For a few weeks, that protein production continued. In 1992, diabetes insipidus symptoms were cured in rats by administering mRNA coding for vasopressin (anti-diuretic hormone). These results led to the hypothesis that an animal’s cells may produce a viral or bacterial protein, which the animal’s immune system would subsequently fight off. The instability of mRNA itself was the only thing getting in the way. It simply dislikes being outside of cells.[20]

The race to find a means to transfer mRNA without it becoming unstable lasted from the 1990s to the 2010s. At that period, advancements were made in the development of vaccinations against cancer, allergies, and parasites. Many businesses were working on mRNA vaccines with somewhat stable delivery mechanisms by the time the coronavirus pandemic hit. They were able to undertake extensive clinical trials almost simultaneously with optimizing their formulations thanks to the urgency of the epidemic and the government financing they obtained.[21]

- What they are and how they work

In the traditional vaccinations, the “weakened” virus (or bacteria), or a portion of it, is typically injected. The immune system detects the “intruder” and creates antibodies it will employ to fight the “actual” invader. On the other hand, in the case of RNA vaccines, the “instruction” is administered to generate a specific protein known as the “spike” protein, which the virus utilizes to “attach” itself to the cells. The “foreign” protein is then created by the cell itself, and once it is recognized, it causes the body to make antibodies.

In 1961, messenger RNA was identified. It is essential for the production of proteins, which is essential to human existence.[22]

Although the DNA does serve as a sort of “storage” for the recipe for making proteins, messenger RNA is ultimately responsible for spreading it throughout the cells and transmitting information about how and when to make proteins.

Hence, messenger RNA functions as a kind of postman who delivers significant signals to the cells. As a result, the concept of injecting information, messenger RNA, into cells to make a therapeutic protein, which was first proposed in the 1990s, was born.

RNA is a transient, delicate molecule that only exists in cells when it is performing a specific purpose and degrades rapidly. The danger is that it could be quickly “demolished” before the message even reaches the cells.[23]

By encasing the fragile RNA molecules inside little bubbles of fat called RNA-lipid nanoparticles (LNP), which were made possible by the development of nanotechnology, they are able to go to their destination unharmed. The messenger RNA molecules are released inside the cell itself as a result of the fat layer fusing with the cell’s outer membrane. The mRNA that includes the instructions required to make the virus’ spike protein is released by the liposomes after they are injected into our bodies. Ribosomes are found in every one of our cells and are responsible for turning mRNA data into proteins. Once the vaccine’s mRNA has entered the cells, the ribosomes will decode it and manufacture several copies of the virus’s Spike protein. [24]

The Spike protein will leave the cell after being produced, at which point the immune system will identify it as foreign. It is crucial to emphasize that, although causing an immune response, the Spike protein alone cannot cause disease because it only makes up a small portion of the virus.

The immune system is now in the process of working. It begins making memory cells and antibodies against the Spike protein of the virus. The Spike protein will be blocked by the antibodies, preventing the virus from spreading. The body’s memory cells will continue to exist and act as a form of defense throughout time.[25]

- Production and supply of Covid-19 vaccines

On January 11, 2020, the genetic code of SARS-CoV-2, the coronavirus that causes COVID-19, was made public. This sparked a surge in global R&D efforts to create a vaccine to prevent the illness. The first COVID-19 vaccine candidate entered human clinical testing with unprecedented speed on March 16, 2020, as a result of an evaluation of next-generation vaccine technology platforms using novel paradigms to speed up development. This was made possible by the scope of the COVID-19 pandemic’s humanitarian and economic impacts.

The difficulty lay in producing the vaccinations in sufficient quantity to give the world’s population immunity as soon as possible. Indeed, the challenges of figuring out how to expand the manufacturing of vaccine doses to combat the pandemic have been made more difficult by how quickly safe and effective vaccines have been created and approved for emergency use. The amount of time necessary for such learning to take place has been severely constrained. Even though there was no guarantee that any of the vaccine candidates would ultimately be licensed for use, vaccine developers and government and civil society organizations concerned with the COVID situation had to create plans for the mass manufacture of vaccine.[26]

Achieving access to manufacturing facilities, obtaining raw materials for the manufacturing process, and scaling up production to achieve high levels of efficiency have all been necessary for the mass manufacture of the vaccines. The developers started working with one or more manufacturing partners as soon as a vaccine candidates entered the first stage of clinical trials to expand the capacity to mass produce at the fastest attainable rate. The fact that the vaccines now approved for emergency use in various nations were produced utilizing cutting-edge technologies complicates the difficulty of mass producing COVID vaccines. Among other benefits, the creation of mRNA and recombinant-vector vaccines has made it possible to find potent vaccine candidates and move them quickly toward clinical trials. The manufacturers have little past knowledge on the scaling of the process because the technology platforms that have been employed to generate the COVID vaccines are novel.

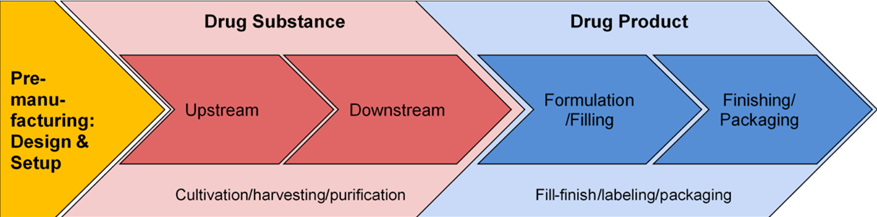

The COVID vaccinations that have been created so far are given intravenously. Scaling up COVID vaccines faces unique difficulties due to the requirement for injectables in large quantities.[27] According to the diagram below, there are three main steps in the COVID vaccine manufacturing process:

- design of the pre-manufacturing process and facility setup;

- manufacture of drug substance (DS), which consists of the vaccine’s active pharmaceutical ingredients (API), which work together to produce antibodies that block viral infections from attacking human cells by neutralizing their effects;

- the process of creating actual drug products (DP), which involves placing bulk DS into syringes or vials that have already been filled. There are a large number of quality control tests spread throughout DS and DP.

Stages of the vaccine-manufacturing process

Tulum, O., Lazonick, W. and Jacobson, K., Scaling of COVID vaccine manufacturing: What manufacturing activities are involved and why are they so difficult? 2021

The two manufacturing stages—DS and DP—involve varying degrees of difficulty depending on the vaccine technology utilized.

The primary production of mRNA vaccines depends critically on an ample supply of lipids. The specialist markets that require lipids are only served by five large producers globally, and these lipid suppliers have their own scaling issues.[28]

Increasing production of previously specialist substances, such as lipid nanoparticles, for a global vaccine drive has been one of the most difficult tasks in recent years. The ionizable cationic lipid (ICL), one of the four lipids that make up the protective droplet in mRNA vaccines, is the one that requires the greatest volume and is covered by limiting patents held by Acuitas Therapeutics, a tiny biotechnology firm in Vancouver, B.C. and a few other businesses.

Additionally, PEGylated Phospholipids (PPLs) are fairly rare. As excipients in COVID vaccines that contain viral-vectored and mRNA, functional lipids are making their vaccination debut. However, PEGylated Lipids have been used therapeutically since 1995, when the US Food and Drug Administration approved the first nanodrug. [29]

The creation of high-quality lipids is the last step of a process that takes around two dozen steps and involves several purification stages to create synthetic ICLs. Only a few suppliers are available globally to complete such a difficult production procedure, with the top three, so 14% of all lipid suppliers, accounting for almost 90% of all citations for lipids worldwide.

Dominating in 2017 with a gigantic 70% share, MilliporeSigma was at the top of the charts for the supply of lipids worldwide. As lipidomics research develops, the company plans to add to its line of more than 1700 lipid products. Avanti Polar Lipids, established in 1967 by Walter A. Shaw, was the second-largest provider of lipid products globally. With a portfolio of more than 2000 distinctive lipid products, Avanti Polar Lipids possessed a 17% share of the global market.[30]

As we previously stated, only a few numbers of businesses worldwide genuinely possess the tools and infrastructure necessary to produce lipid nanoparticles or the unique cationic ionizable lipids. Only a handful of other companies have equipment and facilities that can be upgraded to produce more. For Pieter Cullis, biochemistry professor, considered the “grandfather” of the lipid nanoparticle technology, and co-founder of the company Acuitas Therapeutics, “the holdup seems to be more on the manufacturing of the other components like the ionizable cationic liquid and cholesterol, which are two of the larger components of the lipid nanoparticle.”

Lipid suppliers are unable to meet the pandemic-driven worldwide lipid demand, even after the vaccine producers plan for the retooling of new facilities to enhance production. In addition, the recruitment and training of highly qualified scientific people capable of increasing output while preserving the quality of the lipids has been a key challenge for lipid manufacturers.[31]

Working with other businesses that can upgrade their facilities and increase capacity to make lipid nanoparticles has proven to be the most effective option for vaccine manufacturers to handle these supply chain concerns.

Pfizer, for example, pledged to increase its capacity for producing lipids while simultaneously purchasing lipids from Croda, a British chemical business, and Avanti Polar Lipids, Croda’s Alabama-based subsidiary. Contracts for the Pfizer/BioNTech vaccine also exist with Merck KGaA and Evonik, both of which are situated in Germany. The CEOs of Pfizer and BioNTech formed also a unique agreement with the lipid supplier Polymun in September 2020 to transfer its lipid formulation know-how to Pfizer facilities after signing supply contracts with nearly all major lipid producers. Pfizer was then able to begin producing lipids at its global R&D headquarters in Groton, Connecticut, in March 2021 and raise its projection for worldwide COVID-vaccine production for 2021 by directly controlling the manufacturing of lipids.[32] Then Johnson & Johnson, whose vaccines were produced in collaboration with US-based Merck & Co. Finally, to rise its supply of lipids, Moderna increased its collaboration with CordenPharma, which produces lipids in both Europe and Colorado.

The mRNA vaccine manufacturers have had to learn how to create encapsulated vaccines, which requires the rapid and extensive mixing of mRNA with lipids, even after they have solved the lipid supply problem. The impingement jet mixer (IJM), which is a crucial piece of machinery for this procedure, prepares medication items that can later be filled into vials or syringes and shipped to procurers. The most crucial step in the manufacture of vaccines is the encapsulating of mRNA with LNPs, which requires high levels of accuracy. In order to address the rising demand for mRNA vaccines, it is also necessary to improve the microfluidics mixing solutions already on the market. The fact that there are now just two main IJM providers in the world who are able to upgrade the technology for microfluid and nanofluid mixers further complicates the situation.[33]

After completing the production of vaccines, they are subjected to three distinct phases of clinical development and tested on voluntarily participating patients in clinical trials. The goals are to confirm the vaccine’s safety and to prove the vaccine’s effectiveness. Dose-toxicity studies are a part of the early-phase trials, which help researchers discover how well participants tolerate various dosage levels. The vaccine candidate with the best safety profile is chosen by researchers for the phase III double-blind, placebo-controlled efficacy trials based on the findings of these studies. The move from small-scale vaccine manufacture for clinical trials to the bulk manufacturing of doses for commercial use was significantly impacted by the extreme brevity with which each company’s scientists had to choose its candidate for phase III testing.[34]

The logistics of vaccine distribution for later administration and the expense of cold-chain storage are typically the biggest problems faced by the worldwide vaccination campaigns. Over time, vaccines gradually lose their effectiveness, but high temperatures hasten this process. In order to ensure vaccine stability and immunogenicity, which are diminished even at moderate temperatures, vaccines are often maintained at cold or ultracold temperatures. According to the vaccine platform, different vaccines have different heat sensitivity, and even vaccines developed using the same platform can have different stability profiles depending on the manufacturer.[35]

From the moment of vaccine production until the time of delivery, or just a few hours prior, the cold chain should be maintained. It is the duty of vaccine producers, distributors, public health officials, and healthcare professionals to maintain the cold chain. Three essential components—well-trained staff, dependable storage and temperature monitoring equipment, and precise management of vaccine inventory—make up an effective cold chain. When a vaccine is exposed to an unsuitable environment, such as inadvertent warming or freezing owing to a break in the cold chain, its effectiveness may be reduced and cannot be recovered. A single exposure to a freezing temperature can cause any refrigerated vaccine or diluent to become ineffective. When rapid mass vaccination is required, populations who mistakenly received vaccines that were exposed to unsuitable temperatures should be revaccinated. This requires more doses for the patient and additional expenses for the provider. In particular in climatic zones (i.e., 30°C/65% relative humidity), the need for ultracold temperatures for the storage and transport of the most advanced COVID-19 mRNA vaccines, especially the 70°C freezing condition required by some of them, is a major barrier to vaccine distribution and thus rapid mass immunization. To preserve their quality and effectiveness, these vaccinations should be delivered and maintained in a carefully monitored environment. The equipment for storage and transportation should adhere to WHO standards but it is expensive to purchase.[36]

Depending on the specific formulation of mRNA within LNPs, as well as the vaccine’s lipid and non-lipid components, the ideal temperature level for a vaccine to be stable is determined. When the lipid components utilized in their synthesis fail to bond together, LNPs can become extremely unstable. Physical degradation is another important factor in LNP stability. Aggregation, fusion, and leakage of the pharmaceutical substance that is encapsulated are the three basic categories of physical instability that might happen. The best way to keep a vaccine safe is to keep it at a very low temperature, which varies depending on the formulation of the specific vaccination. It is essential to have instruments to monitor these factors since the integrity and purity of the mRNA are crucial for preserving the effectiveness and safety of mRNA vaccines.[37]

All of the excipients in a vaccine that will be used in clinical trials must be approved by the Food and Drug Administration (FDA). Therefore, several makers created LNPs utilizing lipid components that were already known to be safe in order to minimize regulatory delays in starting clinical trials as well as unanticipated toxicity difficulties.

3.4. Covid-19 vaccines: development, evaluation, approval and monitoring

A significant part of enabling the development, scientific review, approval, and oversight of COVID-19 vaccines in the European Union is played by the European Medicines Agency (EMA) (EU).

The COVID-19 vaccines are created, examined, and approved in accordance with the most recent scientific findings as well as any relevant statutory requirements.

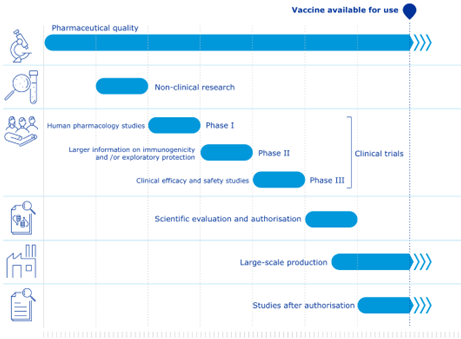

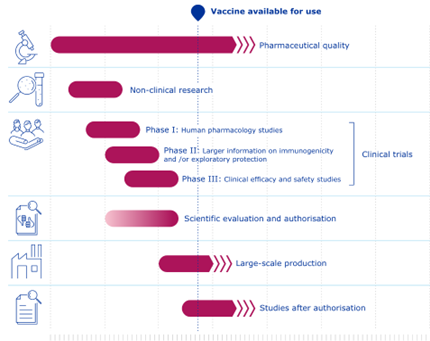

An application incorporating information from multiple studies must be submitted to EMA by a company developing a COVID-19 vaccine. Firstly, studies on pharmaceutical quality reveal information regarding the quality of the vaccine. This covers the vaccine’s active ingredients, purity, and other substances (such as stabilizers), as well as its manufacturing and control processes, stability, and shelf life, and the best ways to store it. Secondly, non-clinical or laboratory investigations that indicate if the vaccine might result in safety issues, which in extreme circumstances could include effects on development or reproduction. Ultimately, human clinical studies that demonstrate a vaccine’s safety and effectiveness.

These trials must examine immunological responses, effectiveness, and safety for COVID-19 vaccines.[38]

The EMA’s recommendations for COVID-19 vaccinations that have been modified are based on all available information, including fresh data for the adapted vaccines and a substantial body of prior research for the COVID-19 vaccines that were initially authorized.

A firm creating a COVID-19 vaccine must also give thorough justifications for the usage of each vaccine component and the manufacturing process it employs.

The COVID-19 vaccinations are initially examined in a lab, then, in experiments known as clinical trials, vaccines are tested on volunteers who are humans. These tests support how the vaccinations function and, more crucially, assist determine their safety and level of protection. Companies can request permission from the European Medicines Agency to market the vaccine in the EU once there is enough information from studies and clinical trials. The European Medicines Agency analyzes all the information and performs a thorough and impartial scientific evaluation of the vaccine. Finally, the European Commission provides an EU marketing authorization based on the scientific evaluation of the Agency. Thereafter, the vaccination can be applied.[39]

Indicative timelines for COVID-19 vaccines compared with standard vaccines:[40]

Figure 1 Standard Vaccines

Figure 2 Covid-19

The pharmaceutical laws of the European Union (EU) make sure that vaccinations are only authorized when a scientific analysis has shown that their overall benefits outweigh their hazards. The advantages of a vaccination in preventing COVID-19 must outweigh any negative effects or potential hazards by a significant margin.

The European Medicines Agency (EMA) makes ensuring that scientists who evaluate drugs are free from financial or other conflicts of interest that can skew their judgment. See Managing opposing interests for further details. The independence of EMA’s scientific evaluations is protected by a high level of transparency, which makes EMA’s scientific evaluation work available for public review. See Transparency: Special Measures for COVID-19 Drugs for further details.

According to the EU pharmaceutical legislation, the usual evaluation period for a drug is up to 210 active days. Nonetheless, EMA handles requests for COVID-19 product marketing authorizations quickly. This enables the review period to be shortened to less than 150 working days. The EMA may employ its COVID-19 rolling review process for potential medications in this context. This enables EMA to evaluate data as they become available throughout the development phase, speeding up the evaluation of the ensuing formal marketing authorisation application.[41]

3.5. Patents and Regulation: a general overview

Pharmaceutical inventions’ patentability has always been a contentious topic of discussion.

Some vaccine technology components are not covered by intellectual property laws. The most notable instance may be the standard formulation for a number of vaccinations that have been around for a while but are no longer protected by patents.

On the other hand, the majority of recently created vaccinations have many parts that can be protected by one or more patents and are frequently so. The era of innovative vaccination R&D free from restrictions imposed by intellectual property laws has been replaced by one where patents are valued highly. [42]

Focusing on the Italian patent in the pharmaceutical industry, it was legitimated by the Constitutional Court only forty years ago (Corte Cost., sent., 20/1978), making it far from a legislative effort. As a result, the original legislative prohibition, which dates back to the reign of Victor Emmanuel II, underwent a revolutionary jurisprudential decision based on a profoundly negative impression of the institution, which was perceived as a tool for monopolistic speculation and a barrier to study.

The Piedmont law of March 12, 1855, No. 782 is where the prohibition against patenting medicines first appeared, and it was finally codified in Article 14, c. 1 of the so-called Inventions Law (Royal Decree June 29, 1939, No. 1127).

The Constitutional Court ruled that Article 14, c. 1., l.i., was unconstitutional because it violated certain constitutional standards (Articles 3, 9, 41, 42, and 43 Const.), marking a turning point in Italian history that saw the principle of drug patentability finally accepted into the country’s legal system.

In addition to the stark contrast with some constitutionally guaranteed values, such as, for example, research and the protection of public health, of which, precisely, research and patenting appear as its instrumental elements, the Court claimed that the reasons that had led the Parliamentary Commission to deny the patentability of drugs years earlier could no longer be considered in line with the current reality.

Given the disparity it created between operators in that field and those in other fields of technology, upholding an absolute ban on patenting in the pharmaceutical field would have disincentivised companies from investing in research and developing a drug, with foreseeable repercussions on the level of competition as well.[43]

The Supreme Court’s decision has historical resonance even today, not only because of the outcome reached after nearly 127 years of supremacy and resistance to the ban on drug patenting, but also because it highlighted the problematic relationship between the use of patents, competition regulation, and health protection, which has recently resurfaced to a significant degree in relation to vaccines.

In the emergency context, the problematic intersection of patents, medications, and competition seems to have resurfaced to a major level, with pharmaceutical firms as the protagonists.

The topic of pharmaceutical patents has never been as important as it is at the historical moment marked by the Covid-19 pandemic, particularly when it comes to the issue of vaccines, the scope of which, from a competitive point of view, lends itself to dynamics quite different from those defining the pharmaceutical sector due to the complexity of the patents and the complete absence of a generic version in the vaccine industry.[44]

Most people have developed a strong sense of rejection with regard to intellectual property rights as a result of the health and socioeconomic crisis, which has served as fertile ground for the reemergence of issues and uncertainties and exacerbated the negative perception of the colossus of Big Pharma (Pfizer, Roche, AstraZeneca, Johnson&Johnson, Novartis…). Based on these presumptions, many scenarios and the potential influence of the patent institution were extensively addressed, but the main focus was on how to be able to balance the competing interests in a way that is both essential and desirable.

There have been a variety of proposals and points of view on the matter, ranging from the use of the instrument of compulsory licensing mentioned in Articles 70 and following of the Industrial Property Code and Article 33 of the TRIPs Agreement to the expropriation of patent rights for public utility, all the way up to a suspension or complete abolition of the patent as proposed by Asia and South Africa in October 2020 and referred to by some as “dead-end streets“.[45]

The attitude adopted by some of the top pharmaceutical corporations, for which analytical authoritative doctrine is referred to elsewhere, is one of the many elements that are not taken into account.[46]

Regarding the position taken by our government, direct legislative action was taken, following the approval by the Houses of Parliament of the amendment sought by the former Minister of Health to the so-called “D.l. Recovery” (Decree Law No. May 31, 2021, no. 77, Governance of the National Recovery and Resilience Plan and Initial Measures to Strengthen Administrative Structures and Accelerate and Streamline Procedures), novating the Industrial Property Code by introducing a new provision – Article 70-bis – bearing the possibility of resorting to the instrument of compulsory licensing for drugs and vaccines in the event of a health emergency.

Thus, the government was given the authority to require patent holders of drugs and vaccines to grant their non-exclusive use to the state or third parties, subject to a few requirements: that the licensing company receives adequate compensation; that the drugs and vaccines are “essential” to deal with the emergency; and that there is a “proven difficulty of supply.” This is, of course, a temporary concession, lasting only as long as the emergency lasts and no longer than twelve months after it ends.

The Marrakesh Agreement, which led to the creation of the World Trade Organization on January 1, 1995, is a milestone in the history of international intellectual property protection. It was the biggest change to global trade since the end of World War II.

The two primary responsibilities of the WTO are outlined in Article III of the Marrakesh Agreement: 1) a forum for negotiations over rules governing international trade; 2) a body for the resolution of problems involving international trade.

The fundamental premise that the protection of intellectual property rights advances technological innovation and makes it easier to transfer and disseminate technological information for the “mutual benefit of producers and users” of technological knowledge is the basis for the TRIPs understanding.

In order to better strike a balance between the legitimate interests of rights holders and users, the framework additionally stipulates that the exclusive rights granted may be subject to restrictions and exceptions.

“In exceptional circumstances, the Ministerial Conference may decide to grant a waiver of an obligation imposed on a Member by this Agreement or by a Multilateral Trade Agreement, provided that such a decision is taken by three-fourths of the Members, unless otherwise provided (…)”. This is stated in Article IX, “Decision-making Process,” para. 3 of the Marrakesh Agreement. In addition, Paragraph 4 mandates that the extenuating circumstances supporting the choice, the rules for how the waiver will be used, and the waiver’s expiration date all be made clear.

The exceptions system that permits the exclusive rights of patent holders to be waived is more specifically regulated by the TRIPs Agreement. They can be divided into two categories: general exclusions (Article 30 TRIPs Agreement) and flexibilities available to WTO member states (Article 31 TRIPs Agreement).

The requirement in Article 31(h) of the TRIPS Agreement that the patent holder for whom a “other use” is approved receive appropriate compensation that takes into account the economic worth of the authorisation may be disregarded in accordance with Article 31bis. The European Union implemented Regulation (EC) No. 816/200620 in accordance with Article 31bis of the TRIPS Agreement, which regulates the granting of compulsory licenses for patents and supplementary protection certificates (SPCs) for the production and sale of pharmaceutical products intended for export to states that require them for public health needs.

As part of the proposed initiatives for the “suspension” of patent protection, the governments of India and South Africa sent a joint proposal to the World Trade Organization on October 2, 2020, asking for a derogation from the terms of Article IX, clauses 3 and 4, of the Marrakesh Agreement with regard to patents and other intellectual property rights related to vaccines, drugs, and other medical technologies for the duration of the pandemic, until the point at which the pandemic has been eradicated.

The TRIPS Council has discussed the initiative of India and South Africa in several meetings, but finally, the World Trade Organization, during a Ministerial Conference, Twelfth Session, in Geneva, June 12-15, 2022, released a document that also covered the topic of Covid vaccines and other intellectual property measures related to vaccines and medical tools useful in containing and combating Covid 19 infection:

“Notwithstanding the provision of patent rights under its domestic legislation, an eligible Member[47]may limit the rights provided for under Article 28.1 of the TRIPS Agreement (hereinafter “the Agreement”) by authorizing the use of the subject matter of a patent[48]required for the production and supply of COVID-19 vaccines without the consent of the right holder to the extent necessary to address the COVID-19 pandemic”.

The World Trade Organization (WTO) document, which was endorsed by 164 member countries, permits the “waiving of certain requirements regarding the compulsory licensing of COVID-19 vaccines,” though the text makes clear that the measure only lasts for five years and is only intended for certain nations.

3.6. Patents and Regulation: the Covid-19 case

Since the introduction of the initial SARS-CoV-2 vaccinations, often known as Covid vaccines, in several countries, the challenge has been to both assure their accessibility to the world’s poorest nations, for whom market prices are unaffordable, to secure their availability through domestic production, to prevent undue demands on the public purse, and to avoid unnecessary burdens. For this reason, expropriations and other authoritative measures have been suggested.

At the time, neither known patent applications nor particular patents on vaccinations against SARS-CoV-2 could possibly exist. Actually, the SARS-CoV-2 virus sequence was originally reported on 10.1.2020, making that date the official date the virus became known. No application for a patent on a SARS-CoV-2 vaccine may be accessed before July 2021 due to the 18 months of confidentiality. And this is true even in the case that vaccination could be created as soon as the sequence was filed. Only a request for early publication can waive secrecy.[49]

From a purely economic standpoint, it is important to keep in mind that neither under Italian nor international law are compulsory licenses and expropriations free of charge.

Italian law stipulates that the expropriated holder must be compensated “on the basis of the market value” (CPI, art. 142). As the Constitutional Court has repeatedly stated in cases involving real estate expropriations, “on the basis” does not always imply full value, but one could not go significantly below it either. It is simply not conceivable to expropriate a patent for free or to pay substantially less for it than its market worth, since the applicable patent’s value for a Covid vaccination would surely be quite high.

The same holds true for mandatory licensing. The Covid outbreak led to the introduction of a rule-specific regulation for health emergencies that offers the holder an “appropriate remuneration… determined taking into account the economic value of the licence” (CPI, Art. 70a). Additionally, the compensation was not small in the few compulsory licenses that were previously given (although in different circumstances).

But there is a more significant issue that makes drastic measures like expropriations, mandatory licenses, and other similar practically impossible. In reality, these actions must be ordered in respect to particular patents; in other words, any expropriation, compulsory license, or other step must expressly state which patent(s) it refers to. This would only be possible in the case of a vaccination if its patent coverage was evident or at the very least simple to verify. However, this is typically not the case with vaccinations, and it certainly isn’t the case for Covid vaccines, for which the patent situation is complicated.

We should keep in mind that each vaccine is made up of numerous parts and is the result of a vast amount of knowledge that has been developed over time and even by different subjects, each of whom has a portfolio of patents that may be relevant to the vaccine itself and thus require licenses.

As a result, each vaccination may not only be covered by one or more patents owned by the firm that developed it, but also by several licenses on patents owned by other businesses. Patents that don’t always directly claim a vaccine because they can cover things like individual parts or different ways to deliver or stabilize the vaccine themselves (which complicates vaccine patent searches).

The so-called Spike protein is the basis for the Covid vaccines in particular, or at least the ones that have received the most attention. It is a feature of the virus that enables entry of the virus into the cell itself as well as attachment and fusion with the cell. The Spike protein, or more specifically, a portion of it, is the antigen, or the substance that the immune system recognizes, and which prompts an immunological response. The Spike protein is triggered in diverse ways in the numerous vaccinations.

Each of these vaccines has a wealth of knowledge that has been accumulated over many years and has gradually allowed the solutions to an equal number of difficulties. Many solutions are covered by patents owned by parties other than the developing company, which necessitates licenses and occasionally legal action.

In very general terms, it should already be recalled that because mRNA is so unstable, it must be enclosed in tiny fat particles known as lipid nanoparticles (LNPs), which have been extensively studied for decades and are the subject of a large number of patents from companies that are either competing manufacturers or wholly unrelated to the production of vaccines. Additionally, modified forms of mRNA must be employed, which are also trademarked by various firms, in order to preserve it against degradation. Finally, a mutation that codes for a Spike protein with a conformation that prevents the virus from fusing into the cell is a very significant change. In connection with this, there are significant patents that vaccine producers must deal with.

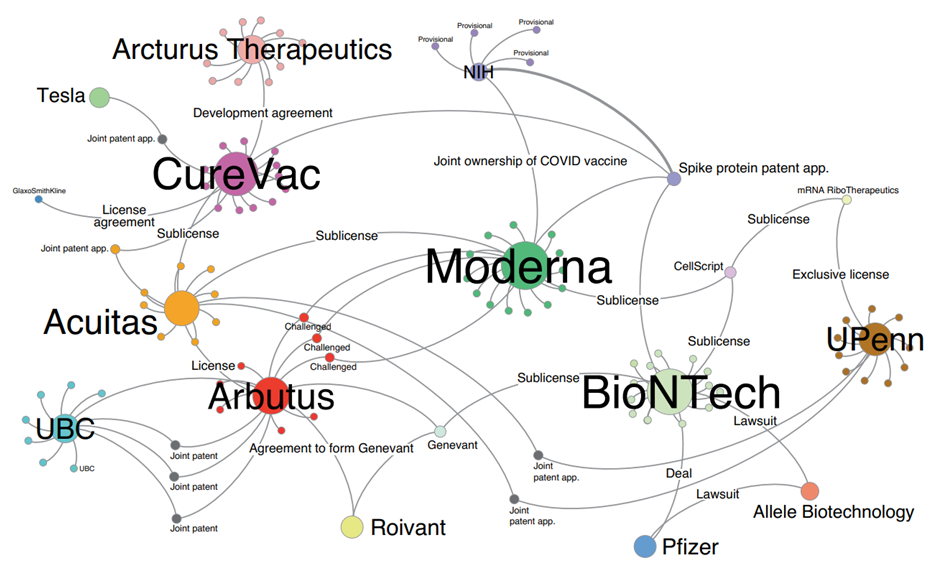

Each mRNA vaccine in such a situation is found to be protected by numerous other patents, which means that producing it may require numerous licenses and cross-licences, many of which are not available to the general public. The scenario, which is so complex that it was defined as a “patent maze” by Ulrich Storz (The patent maze of COVID 19 vaccines, 2021) was previously visualized as follows:

Fig. from Patent network analysis of mRNA-based vaccine candidates for COVID-19.[50]

The situation is just as complex for vaccinations other than mRNA vaccines.

Going back to the beginning, it is evident that it would be virtually impossible in such a circumstance to identify the pertinent patents for the purposes of potential expropriation or coercive licensing. Without leaving out the fact that it would be required to be antagonistic and to arrange recompense with each holder. This makes authoritative interventions of this kind seem unworkable.

Evidently aware of the situation, some nations had suggested an intervention of a completely different kind inside the framework of the World Health Organization. The proposal called for a “waiver” that would have released member states from the requirement to uphold specific TRIPS agreement provisions “in relation to the prevention, containment and treatment of Covid-19” for a predetermined period of years, in place of expropriations or compulsory licenses on specific patents.[51] These requirements were included in Part II’s Articles 1, 4, 5, and 7, which dealt with copyright, design patents, and secret information. This meant that any patent, know-how, or other protection would be invalid if it had anything to do with preventing, containing, or treating Covid. And all of this happens automatically, wherever in the world, without the need for any special precautions. However, a less comprehensive choice, the scope of which we previously discussed, ultimately replaced this suggestion.[52]

The World Trade Organizations’ final decision has never actually been put into reality (Article 5 states that in order to use it, a state must first notify the Council of TRIPS, which hasn’t yet received any notifications).

One issue, justifying this situation, is that any waiver would have to refer to individual patents, which would be outside the realm of possibility as previously mentioned. But there are other, more significant and widespread causes. First of all, only the technologically most advanced regions, like North America, Western Europe, China, and Japan, are typically granted patents on so-called “enabling technologies” in the pharmaceutical industry.[53] Developing nations are normally not mentioned in such designations. Furthermore, knowledge plays a crucial part in the development of vaccinations; therefore, it is maybe useless to try to patent vaccines in nations where such knowledge cannot be assimilated. To this, it must be emphasized that many vaccinations, particularly mRNA vaccines, require cold chains and other organizational tools that are sometimes not feasible in developing nations. Significantly, according to a head of the UN-reporting organization known as the Medicines Patent Pool, not a single patent for mRNA vaccines has been submitted anywhere on the African continent.[54]

As was previously indicated, the patent situation is extremely problematic for vaccinations against SARS-CoV-2.

Both those using messenger RNA and those using an adenoviral vector, along with the others, are built on knowledge and technologies that have been gradually introduced over the years by a variety of different actors. The discovery of the virus in January 2020 allowed for the addition of the final contributions. Such a quick creation of these vaccinations would not have been conceivable without this pre-existing body of scientific knowledge.

This has the logical consequence that the vaccines themselves are, in one way or another, protected by patents or applications from numerous corporations, with claims that can occasionally be too broad to be avoided.

Regarding mRNA vaccines specifically, it should be noted that the combination of these with lipid nanoparticles (LNP) represents the development of studies that started more than forty years ago. It has been recognized to transport mRNA inside murine and human cells by causing protein synthesis since the late 1970s when it was encapsulated in liposomes.[55]

Several patents claiming LNPs or other lipid particles with specified properties mixed with mRNA or other types of RNA had been submitted in the later but still not recent years.

Some long-standing patent applications, which particularly address the use of mRNA as a vaccine, have gradually shifted their attention to the coronavirus family by means of continuations.

In particular, CureVac submitted an international application in 2007 that was published as WO2009030254 and whose main claim comprised a complexed RNA as its topic. Many years later, CureVac filed the US application US20210060175 through a series of continuations. In this application, CureVac carved out new claims specifically for SARS viruses while also retrieving certain information from the description of the original international application. Similarly, CureVac filed an international application in 2011 that was published as WO2012116811, in which it made extremely general claims about an mRNA vaccine. Years later, through a series of continuations, CureVac filed US application US20210032199, in which it carved out a new, more specific claim for vaccinations against SARS-CoV by using data from the description of the original application international application.

Moderna, on the other hand, is the owner of later patents, which since the initial application have a more focused scope. With regard to this, the main claim of the patent US10702600 (priority 2015) states: “Composition comprising a ribonucleic acid messenger (mRNA) comprising an open reading frame encoding for a S protein or for a subunit of beta-coronavirus S protein (BetaCov), formulated in a lipid nanoparticle“.

SARS-CoV-2 is a member of the betacoronavirus subfamily. Therefore, the other mRNA vaccines against SARS-CoV-2 can be included in this claim.

Additional issues with mRNA vaccines include its volatility and a few negative side effects. The inclusion of a modified uridine or pseudouridine was suggested in light of these long-known issues. The University of Pennsylvania (UPenn) has a number of patents pertaining to this, the most important of which is US 8278036 (priority 2005)[56], whose main claim relates to a “method for inducing a mammalian cell to produce a protein of interest, comprising contacting said mammalian cell with modified RNA modified RNA synthesised in vitro, encoding for a protein of interest, wherein said modified RNA comprises the pseudo”. Neither in this claim nor in others vaccination is expressly mentioned.

Both Pfizer-BioNTech and Moderna vaccines make use of 1-methylpseudouridine, which is also a modified uridine and hence falls under the above-mentioned patent.

Biontech has precisely secured a licence from UPenn[57]. For its part, Moderna, a few years after UPenn, had applied for a number of more specific patents, including US9428535 (priority 2011), claiming a “method for expressing a polypeptide of interest in a mammalian subject, comprising administering to said subject a isolated mRNA comprising … wherein said isolated mRNA is completely modified with 1-methylpseudouridine”.

Since the prior patent from UPenn explicitly mentions in the description that pseudouridine includes 1-methylpseudouridine, it appears that this patent is dependent on that one.

Further patents originate from research carried out in earlier years on the SARS Cov-1 and MERS (Middle East Respiratory Syndrome), by research groups from the National Institutes of Health (NIH) of the US Department of Health. In that research a mutation in the Spike protein was uncovered protein that compelled the protein itself to maintain a conformation that prohibited the virus from merging with the cell. It was then realised that, by blocking the Spike protein in that conformation, known as pre-fusion, one could allow more time for the immune system to produce antibodies against it. Proline was substituted for two amino acids at positions 968 and 969 in the aforementioned mutation (K968P and V969P substitutions). For this reason, we use the term “2P mutation.”

One result of this research was the application WO2018081318 (priority 2016) following which, in 2021, was issued patent US patent US10960070.

As a reminder, the sequencing of the SARS-CoV-2 virus was released in early 2020, therefore straddling between the filing and granted of this patent. Later, it was discovered that the identical 2P mutation (K968P and V969P) results in the same favorable features reported in the aforementioned application in reference to other coronaviruses even in the Spike protein of SARS-CoV-2. It was then discovered that the identical mutant protein is encoded by the mRNA in all three vaccines from Pfizer BioNTech, Moderna, and CureVac. And the DNA in Janssen’s adenoviral vector vaccine follows the same rules. Therefore, it is conceivable that all three businesses need Department of Health licenses.[58]

Following the deposition of the SARS-CoV-2 virus sequence, several companies filed patent applications within a short period of time: Moderna (WO2021154763, priority 28.1.2020), CureVac (WO2021156267, priority 4.2.2020), BioNTech (WO 2021213924, priority 22.4.2020).

In one way or another, each of these three applications makes a claim regarding the identical mutant 2P protein and/or the mRNA that codes for it. It appears that all three applicants combined the sequence of the 2P mutant protein with the information made available by the Department of Health[59] in the same way.

Evidently, the time period was too brief to collect experimental data; in fact, the topics covered in these inquiries are rather broad. At least the principal claims of all three inquiries were deemed to lack innovation or imaginative activity in international study reports. It remains to be seen if patents will be issued on the basis of them and with what claims, of course.

What is currently apparent is a fact that seems unusual. That is, despite the Covid vaccines’ immense value from a health perspective, it is by no means a given that they will enjoy substantial protection from a patent perspective.

Anyway, considering the evident importance and relevance of the recent global health crisis, in order to encourage investment and expand access to more inexpensive medications for the European population, the European Union is reforming the laws governing the pharmaceutical business. Covid and rare disease-related shortages of essential medications have brought to light a number of difficulties, including falling European production, serious challenges with supply chains, and a lack of readiness for international health emergencies. For a 136-billion-euro European market, the Commission appears to be preparing to publish a draft reform on April 26, 2023, which will include the most significant revision of the current medical regulations in 20 years. It is particularly important to draw attention to how, according to the Reuters news agency, one of the proposed changes would reduce the length of intellectual property (IP) protection for businesses that create and market medicines in Europe.

3.7. Pharmaceutical inventions and the complex relationship between industrial property rights and health protection

What for many is an “ideological” fight over the proposition that it is incorrect to recognize patent protection for such crucial assets at such a crucial time appears to ignore the significance of the tools made available for the protection of IP rights (in our case, the patent) in the context of the innovation undertaken by businesses.

Using the same terms used in the Manual of Industrial Law’s chapter on patents by A. Vanzetti-V. Di Cataldo, “Innovation is one of the essential moments of company activity. An entrepreneur who develops a novel concept and implements it into his company gains an advantage over rivals in the industry, which could make all the difference to his financial success.